Key takeaways:

- The negative correlation between stocks and bonds that was the bedrock of diversification for the 60/40 portfolio has flipped to the positive side as inflation has been elevated.

- A persistent inflationary environment could continue to be challenging for the 60/40 portfolio.

- Replacing a portion of the bond allocation of the 60/40 portfolio with managed futures strategies that have historically proven to be strong diversifiers could help investors navigate a persistent inflationary environment, without creating a drag over the traditional 60/40 portfolio.

Addressing the Traditional 60/40 Portfolio

Retail investors focusing on the 60/40 portfolio have historically been less interested than institutional investors investing in managed futures strategies, also called Commodity Trading Advisors (CTAs), because the bond portion of their portfolios also proved to be an excellent hedge to their equity holdings. This proved true from the early 2000’s until it ended abruptly in the aftermath of the 2020 Covid crisis.

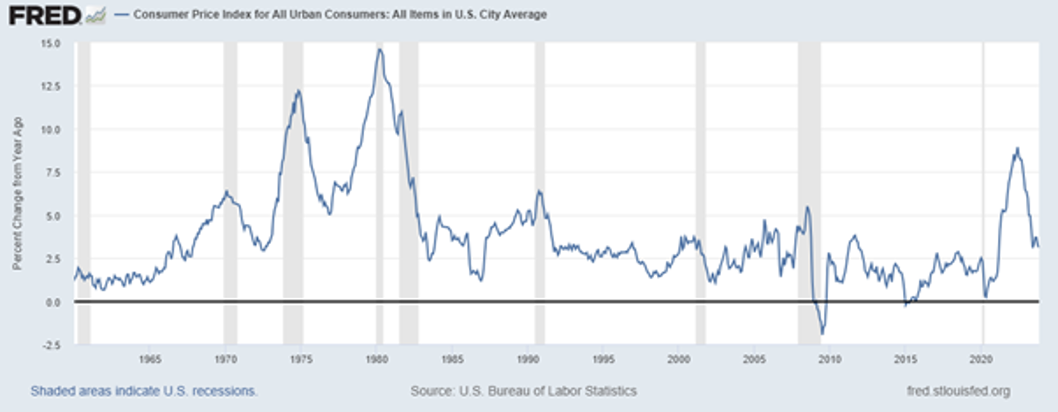

What happened? In the 2nd half of 2021, inflation reared its ugly head to a level not seen since the early 1980’s, as the chart below depicts.

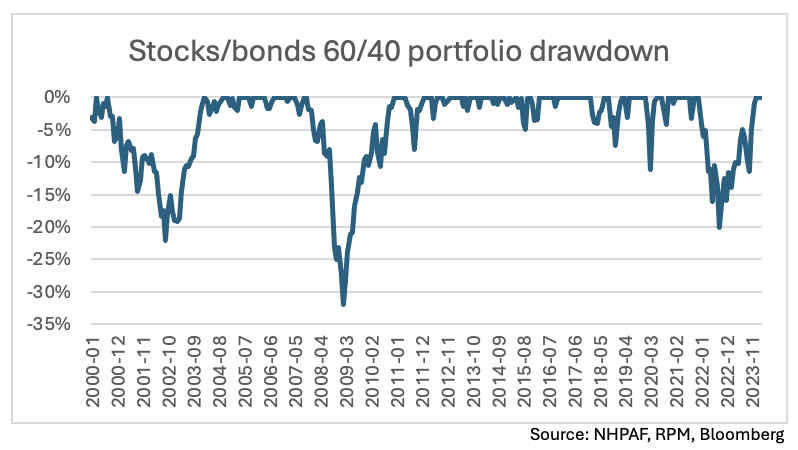

This resurgence of inflation proved to be the Achilles Heel for the 60/40 portfolio, which posted its first double-digit loss since the 2008 Financial Crisis.

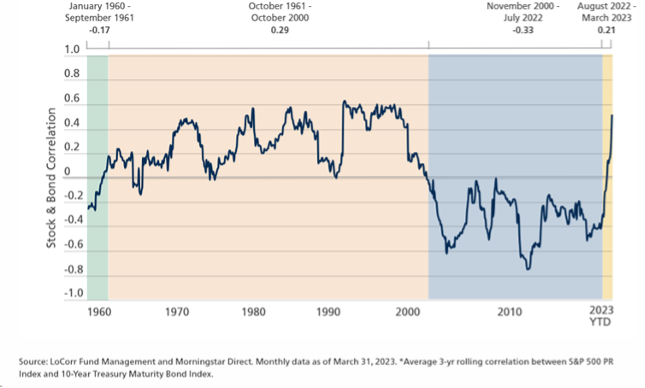

The main reason for the severity of this drawdown was that both stocks AND bonds suffered at the same time, something that had not happened yet in this century. Due to 40 years of falling interest rates, bonds had exhibited negative correlation relative to stocks, which made them an effective hedge against stock market drawdowns, as evidenced by the chart below.

On this chart, the correlation environment – positive or negative – is clearly identified, as is the recent move up in correlation, which begs the question: has the correlation switched back to a positive correlation environment, as during the 1961-2000 period?

Going back to the inflation chart, one can easily identify the parallel between the higher inflation environment of the 1970’s to the early 1990’s as the root cause of the positive stocks/bonds correlation. During these decades, persistent inflation was front and center in the mind of market participants who reacted strongly to news of higher inflation by selling both bonds and stocks, and vice versa.

The US Federal Reserve’s aggressive monetary policy, though it started late, has done a good job of bringing inflation back down towards their 2% target. Whether they are successful, or inflation remains persistent, is anyone’s guess. We won’t pretend to be able predict the future, but we can draw some informed conclusions based on history.

Managed Futures Replacing Bonds

The proposition that managed futures was superior to bonds in 2022 is undisputed. From that period, and previous periods, of high and rising inflation, we can also infer that managed futures is the better option in those environments. What about other periods?

CTAs Emerge

Commodity Trading advisors have been around since the 1970s, but as the chart below shows, it hasn’t been until the early 2000’s that investors really took notice.

Source: Barclay Hedge

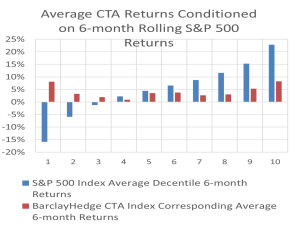

The Great Financial crisis was a wake-up call for many institutional investors who noticed the risk-mitigating properties of CTAs then and started allocating a portion of their assets to these strategies. The charts below highlight the risk mitigating properties of CTAs during stock market drawdowns. In every single 6-month period where the S&P 500 Index has suffered losses of more than 15%, the managed futures industry has posted positive returns.

Source: Bloomberg, Barclay Hedge, NHPAF, RPM

Source: Bloomberg, BarclayHedge, NHPAF, RPM

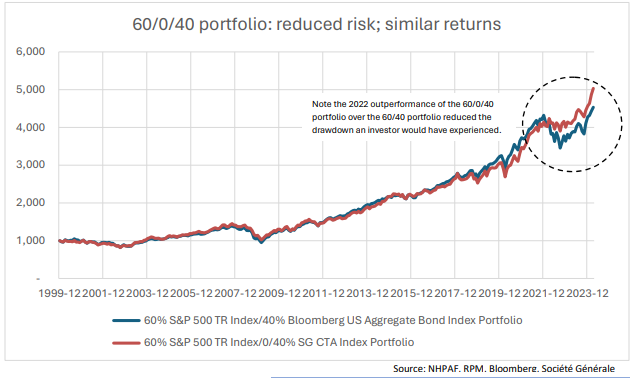

Let’s perform the following thought experiment. We simply replace bonds with managed futures as the main portfolio diversifier in the period from Jan 2000 to Dec 2023. As the graph below illustrates, the two portfolio combinations perform very much in line up until the end of 2021. Note that during the whole period from 2000 to 2021, interest rates were falling, driving bond prices up.

The portfolio stats for the two portfolios in the period 2000-2023 look like this:

The characteristics of the two portfolios look very similar over the long run. And while the 60/40 portfolio slightly outperformed the 60/0/40 portfolio during the long period of benign inflation from 2000 to 2021, due to the massive outperformance of the 60/0/40 portfolio during the inflationary environment of 2022, the 60/0/40 gained a slight edge over the full period.

Conclusion

The decision to replace the entire bond book with managed futures strategies is admittedly drastic but the main take-away is that managed futures is an excellent complement to equities and an excellent replacement for bonds, in basically any given mid- to long-term scenario. As such, investors looking to build a portfolio that can weather all market cycles, including periods of inflation, should consider replacing a portion of their bond portfolio with managed futures strategies.

About New Hyde Park Alternative Funds, LLC

New Hyde Park Alternative Funds, LLC (NHPAF) was created in 2013 to meet increased investor demand for more flexible and transparent investing solutions. NHPAF is a Midwest-based, independent provider offering bespoke managed account platform (MAP) solutions to the investing community. NHPAF serves as the sponsor of the Galaxy Plus External Managed Account Platform, as well as Galaxy Private, NHPAF’s Dedicated Managed Account Platform solution. NHPAF is an NFA registered Commodity Pool Operator (CPO) and Commodity Trading Advisor (CTA). Visit NHPAF.com.

AN INVESTMENT IN ANY FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. THE PAST RESULTS OF A FUND AND/OR ITS TRADING ADVISOR ARE NOT INDICATIVE OF HOW SUCH FUND WILL PERFORM IN THE FUTURE. 3462-NHPAF-04302024