The year 2024 appears to continue where 2023 left off, with economic surprises and evolving market dynamics. The economy demonstrated resilience during the first quarter of the year, continuing to avoid a recession and performing better than anticipated. Investors initially expected a soft landing, with improved inflation and rate cuts by the Federal Reserve beginning in March. However, inflation remained sticky, leading to a delay in rate cuts until at least June as expectations shifted from five rate cuts to now centering around three at best.

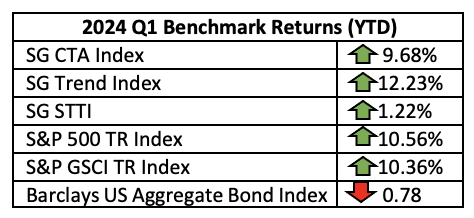

Despite diminished rate cut expectations, stocks, following the growth story, surged over 10% during Q1 2024. Total returns over the past 12 months have reached nearly 30%, with technology stocks leading the charge and the rally extending to value stocks. However, the bond market faced challenges due to the Fed postponing rate cuts and investors pricing in the possibility of only one to two rate cuts this year.

This was emphasized by Fed Governor Michelle Bowman who acknowledged the possibility of higher interest rates in the post-pandemic world. While not the baseline outlook, she sees the risk of further rate increases if inflation stalls or reverses.

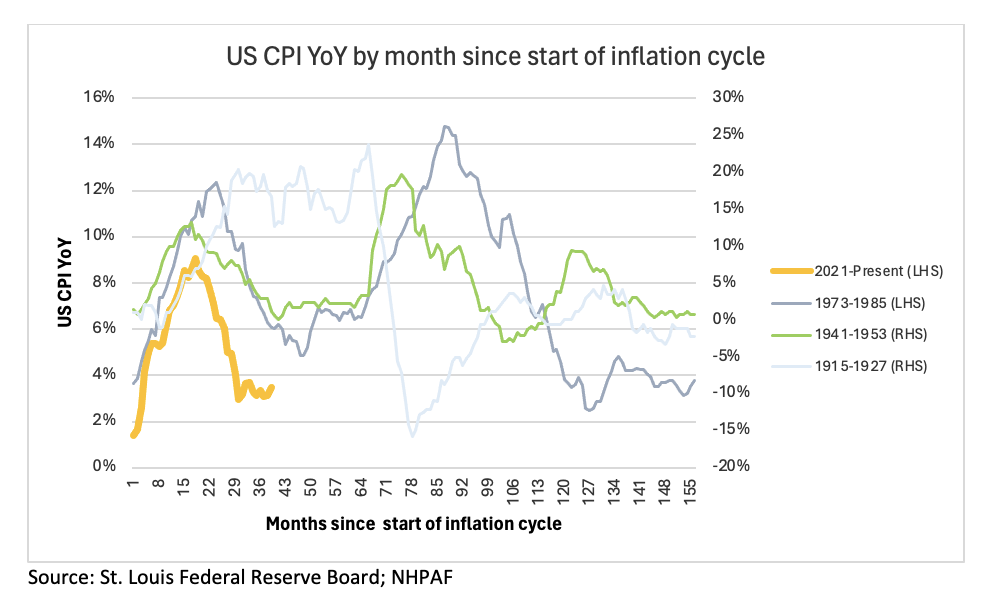

Turning to historical inflation cycles, it is interesting to note that the previous three inflationary cycles were all multi-wave cycles, with at least two consecutive waves of inflation, as the chart below depicts. Perhaps it is the historical patterns reflected on this chart that give Fed officials pause and has kept them from loosening their monetary policy.

Source: St. Louis Federal Reserve Board; NHPAF

Is it a coincidence that inflation seems more stubborn and that commodity prices bounced back sharply as the GSCI Commodity Total Return Index was up 10.4% during the first quarter of the year? Certainly, the Fed will be watching the evolution of commodity prices and their potential impact on future inflation data when considering the timing of potential rate cuts.

As we reexamine the four scenarios which we believe could unfold:

- The “soft-landing” which the Fed is looking to engineer, and was the prevalent scenario at the beginning of the year seems to have lost some ground;

- A “hard landing”, which would quickly bring the recession that has eluded many economists, seems even less likely as economic indicators, especially unemployment, stayed strong;

- “Stagflation” where inflation is persistent, causing the Fed to keep rates elevated at the cost of economic growth, and seems unlikely given the current economic strength;

- The Fed tolerates “higher inflation” for a while so as to not sacrifice growth and full employment is a scenario that increased in likelihood as inflation remained more stubborn than expected, raising the possibility of a second inflation wave as has happened during previous inflationary cycles.

The shift in rate cut expectations are further affected by this election year dynamics: officials may hesitate to lower rates closer to the elections to avoid political entanglements.

It’s worth noting that, last quarter, the Swiss National Bank was the first central bank to ease their monetary policy in this cycle. They have the benefit of a strong currency which allows them to export some of their inflation, making the first-mover decision easier. Also noteworthy is the fact that the Bank of Japan raised rates for the first time in 17 years in a move that was long anticipated.

While geopolitical tensions remained high, besides keeping the price of crude oil somewhat elevated, they didn’t seem to affect other risk assets like stocks.

In February, the 60/40 portfolio finished recovering from the drawdown that began in January 2022, at least in nominal terms. Adjusted for inflation, the same drawdown started earlier in September 2021, and is only about two thirds of the way back from its September 2022 bottom. After three positive months, the 60/40 portfolio was up almost 5.5% year-to-date.

In managed futures, the big story this past quarter, especially for trend followers, was cocoa, the price of which increased to over $10,000 per ton from about $4,000 per ton at the beginning of the year. It was hard to avoid the news on TV about the rising price of chocolate which coincided with the approach of Easter. Overall, commodities were strong contributors to the performance, as were equities, leading to a year-to-date performance of +9.7% for the SG CTA Index and +12.2% for the SG Trend Index. Short-term traders had a more difficult start to the year due to a softening volatility environment leading to a +1.2% for the SG STTI Index.

As usual, we will advocate that investors be prudent. Stocks, which have clung to the growth story, could face pressure from prolonged higher rates. Those same prolonged higher rates could also put pressure on bond prices as in the scenario put forward by Fed Governor Bowman. Furthermore, in a higher-for-longer scenario, the focus may return to addressing high levels of indebtedness and the cost of servicing that debt.

Investors should closely monitor inflation, rate decisions, and election-related factors, but should also strive to diversify their portfolio of risk assets with risk-mitigating strategies like managed futures. These types of strategies may help navigate future uncertainty and mitigate any potential resurgence of volatility, as they have in the past.

We will soon be publishing an article on the benefits of adding trend following strategies to the 60/40 portfolio to diversify both the equity risk and the bond risk. We look forward to discussing this article with you.

For further information about the Galaxy Plus managed account platform, please contact: Marc Lorin, CIO, (630) 566-4521, mlorin@galaxyplus.io.

About Galaxy Plus:

Galaxy Plus is a managed account platform for managers and investors providing an institutional level, “managed account like” experience in alternative assets. The Galaxy Plus Platform is an innovative solution with a flexible structure, increased efficiency, lower costs, increased risk mitigation, and a highly controlled and secure infrastructure.

IMPORTANT DISCLAIMERS:

The author’s point of view reflected in this article should not be construed as investment advice. The CTA strategies noted herein, some of which may be available on the Galaxy Plus platform, do not represent an endorsement of a particular CTA or strategy. The information presented is for illustrative purposes only and is based on the opinion of the author as a result of recent market conditions and does not represent the view of New Hyde Park Alternative Funds, LLC.

AN INVESTMENT IN ANY FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. THE PAST RESULTS OF A FUND AND/OR ITS TRADING ADVISOR ARE NOT INDICATIVE OF HOW SUCH FUND WILL PERFORM IN THE FUTURE. 3459-NHPAF-04182024