As we closed out the second quarter, a slow-moving but consequential shift is underway in financial markets. While President Trump’s tariff policies and expanding fiscal deficits draw headlines, the deeper story is unfolding in the bond market—where long-dormant “bond vigilantes” are beginning to stir.

With the “One Big Beautiful Bill” likely to add $3.4 trillion to the national debt over the next decade, and with inflation running above the Fed’s 2% target, investors are increasingly concerned about the long-term sustainability of U.S. fiscal and monetary policy. Treasury yields have drifted higher, with the 10-year note yielding 4.24% and the 30-year at 4.78%, reflecting both inflation uncertainty and growing skepticism around the government’s ability—or willingness—to rein in deficits.

Bond vigilantes, who sell government bonds in response to excessive spending or inflationary policies, drive up yields as a form of market discipline. When they re-emerge, their collective actions can sharply raise borrowing costs, tighten financial conditions, and force governments or central banks to alter course—often abruptly. And yet, the markets remain relatively orderly. The bond vigilantes, it seems, are absent—but not gone. As we’ve seen in other developed markets, such as the recent rout in UK gilts, a seemingly modest trigger can quickly reignite discipline.

The Summer of Stagflation: Context is Everything

Claudia Sahm, a leading macroeconomist, has framed the coming months as a potential “summer of stagflation”, where markets and the Fed alike will seek clarity across three key fronts:

- The persistence of inflation

- The underlying strength of the labor market

- The evolving shape of Trump’s economic policies, especially tariffs and immigration

On the inflation front, the Fed’s preferred core PCE measure came in at 2.7% in May, still well above target. Meanwhile, the June unemployment rate fell to 4.1%, which is broadly consistent with maximum employment in the Fed’s view. This pairing—elevated inflation and a tight labor market—places monetary policy in a bind. The federal funds rate at 4.3% remains modestly restrictive, but pressure is mounting for the Fed to act.

However, as Sahm reminds us, context matters. One month of data rarely shifts policy. June payrolls exceeded the consensus at 147,000, but that headline number could obscure the real story: a significant slowdown in labor force growth due to reduced immigration, increased deportations, and loss of work authorization. This presents a supply shock that looks very different from waning labor demand.

Analysts now estimate that the break-even rate of job creation may have dropped to as low as 10,000 to 40,000 jobs/month in the second half of 2025, a massive shift from prior years. This makes interpreting labor market softness especially difficult—weak job growth may not signal economic deterioration, but rather constrained labor supply.

Corporate Earnings Under Pressure

Second-quarter earnings reports offered a window into how companies are coping with these dynamics. According to Goldman Sachs Research, many firms have struggled to pass through tariff-related costs to consumers. While their base case assumes 70% pass-through, actual consumer inflation has remained subdued, suggesting firms may be absorbing more cost than expected.

This has placed pressure on margins. The S&P 500’s profit margin fell from 12.1% to 11.6% this quarter, and although Goldman still forecasts 7% EPS growth in 2025, much of that growth is expected to come from resilient sectors like technology, healthcare, and communication services. Broadly, this is a story of selective strength, not general prosperity.

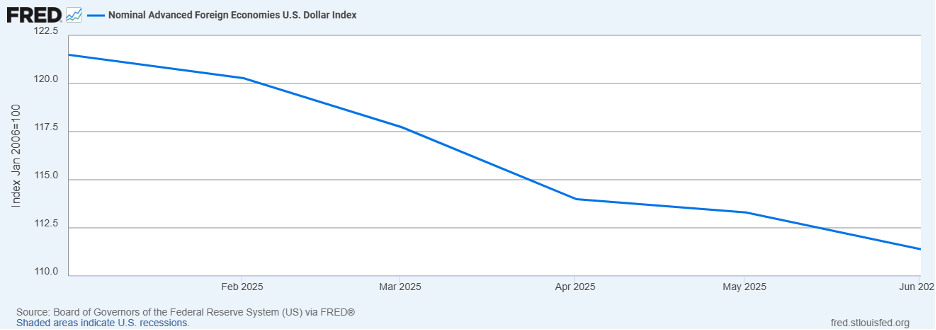

Dollar Weakness: A Vote of No Confidence?

One of the more telling developments this year has been the broad-based weakness of the U.S. dollar, which has declined against most major currencies in 2025 despite relatively high U.S. interest rates. The dollar’s fall—down nearly 7% on a trade-weighted basis year-to-date—suggests that global investors are becoming more skeptical of the long-term sustainability of U.S. fiscal and trade policies. In a typical environment, higher rates would support a stronger dollar, but today’s fiscal expansion, rising inflation, and erratic tariff policy have undermined confidence. Investors are increasingly treating the dollar not as a safe haven, but as a fiscal risk asset, particularly as twin deficits (budget and trade) widen in tandem. For U.S. investors, a weaker dollar may provide some tailwind to international holdings, but it also complicates the Fed’s inflation fight by increasing the cost of imported goods—furthering the stagflationary challenge already taking shape.

The Fed’s Dilemma: Wait-and-See or Act?

Despite mounting political pressure, Chair Powell has remained consistent: the Fed needs more clarity. Only two FOMC voting members currently support a rate cut in July. Powell has described the meeting as neither “off the table” nor “on the table”—a signal that the bar is high.

The summer’s data will be critical, not only in showing how the economy responds to tariffs and immigration policy, but also in determining whether inflation pressures are transitory or entrenched. Powell noted in June

that even if inflation from tariffs is a one-time price level adjustment, it may take longer than markets expect for inflation to return to target.

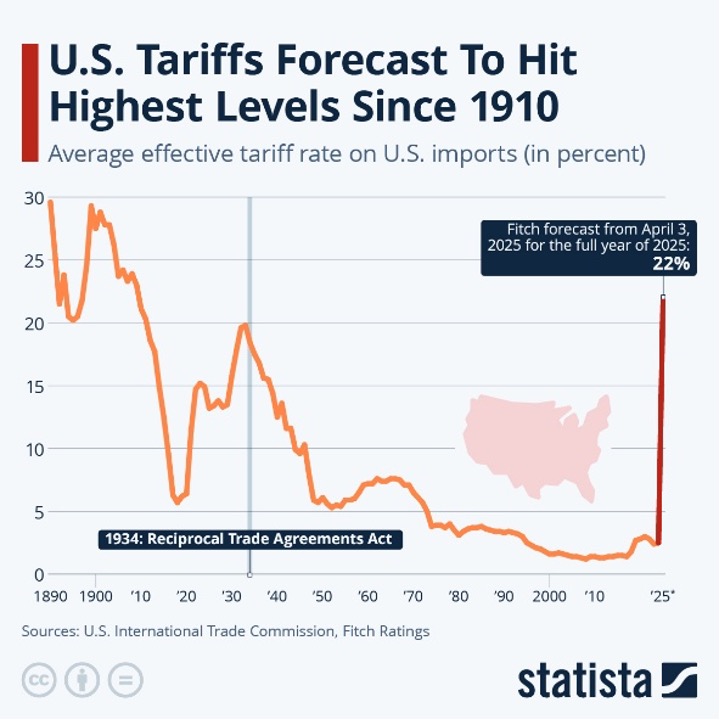

The deadline on country-specific tariffs, initially set for July 9th and later extended to August 1st, is another wildcard. With the newly announced 30% tariff on the EU and Mexico, there’s a real chance that the effective tariff rate will end the summer higher than it began. Already, Yale’s The Budget Lab estimates the overall tariff rate to be 20.6%, the highest since 1910. The Fed has made it clear that higher tariffs increase the risk that inflation deviates from target—and that longer-term expectations become unanchored.

Scenario Update: A Narrower Path Ahead

As these crosscurrents unfold, our macro scenario outlook evolves:

- Stagflation has now become the most likely path, driven by inflationary tariffs and labor supply constraints amid weakening real growth.

- A hard landing becomes plausible if margin compression intensifies, bond yields surge, or immigration restrictions further choke off hiring.

- The soft landing, once promising, is increasingly elusive under the weight of policy-induced volatility.

- The idea of the Fed tolerating higher inflation looks less likely, as the cost of delayed action becomes too great to ignore.

Portfolio Strategy: Rebuilding Resilience

In this complex macro environment, diversification is critical—but not in its traditional form. The 60/40 portfolio model continues to be vulnerable as equities and bonds remain positively correlated. If the bond vigilantes reawaken, both sides of the portfolio may suffer simultaneously.

That’s why we continue to emphasize the importance of alternative strategies:

- Managed futures: With dynamic exposure to global markets, they adapt to trends in interest rates, currencies, commodities, and equity volatility.

- Global macro: Opportunistic in nature, these funds can seek alpha from macro dislocations and policy divergence.

- Real assets and commodity trend: Potential beneficiaries of inflationary pressure and cost-push dynamics.

These strategies have historically thrived during inflationary regimes and dislocated markets, offering convex return profiles and downside protection when traditional risk assets struggle.

Final Thoughts: Watch the Vigilantes

For now, bond markets remain orderly—but that could change quickly. As tariffs evolve, labor supply contracts, and fiscal discipline erodes, the bond vigilantes could reemerge with little warning.

The Fed, for its part, appears well-positioned but divided. If incoming data aligns with its outlook, cuts could begin later this year. But if inflation persists or job market signals become murkier, the path forward could become more fraught. In Sahm’s words, this may become a “stagnation summer”—where the data is noisy, the policy is uncertain, and the room for error is shrinking.

As we navigate the second half of 2025, we urge investors to build resilience—not just for volatility, but for complexity. The calm of today’s bond market should not be mistaken for confidence. The bond vigilantes may seem absent—but they’re watching.

Let’s Connect

If you’d like to discuss your allocation strategy, or how to enhance portfolio resilience through thoughtful diversification, we welcome the opportunity to speak.

| Benchmark | Q2’2025 | YTD |

| S&P 500 TR | 10.9% | 6.2% |

| Bloomberg US Aggregate Bond TR Index | 1.2% | 4.0% |

| S&P GSCI TR | -2.8% | 1.9% |

| US Dollar Index | -6.6% | -9.1% |

| SG CTA Index | -5.2% | -7.6% |

| SG Trend Index | -5.6% | -10.0% |

| SG STTI | -5.3% | -5.3% |

For further information about the Galaxy Plus Managed Account Platform, please contact:

Marc Lorin, CIO, (630) 410-1859, mlorin@galaxyplus.io

About Galaxy Plus:

Galaxy Plus is a managed account platform for managers and investors providing an institutional level, “managed account like” experience in alternative assets. The Galaxy Plus Platform is an innovative solution with a flexible structure, increased efficiency, lower costs, increased risk mitigation, and a highly controlled and secure infrastructure.

IMPORTANT DISCLAIMERS:

The author’s point of view reflected in this article should not be construed as investment advice. The CTA strategies noted herein, some of which may be available on the Galaxy Plus platform, do not represent an endorsement of a particular CTA or strategy. The information presented is for illustrative purposes only and is based on the opinion of the author as a result of recent market conditions and does not represent the view of New Hyde Park Alternative Funds, LLC.

AN INVESTMENT IN ANY FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. THE PAST RESULTS OF A FUND AND/OR ITS TRADING ADVISOR ARE NOT INDICATIVE OF HOW SUCH FUND WILL PERFORM IN THE FUTURE. 3531-NHPAF-07162025